Looking for a powerful strategy for your rental investments?

Are you ready to take your rental investments to the next level? That means boosting your cash flow, multiplying your equity, and keeping more money in your pocket.

For years, real estate investors have used a strategy similar to what Bigger Pockets calls “BRRRR” (Buy, Rehab, Rent, Refinance, Repeat). BRRRR works great and has proven time and again to produce lucrative business for investors. However, there’s a step that’s often forgotten (or unknown) to many investors:

Setting up the financing properly.

Unfortunately, the majority of investors waste precious time and money because they fail to set up their short-term and long-term loans correctly. This failure leads to missed opportunities, slower processing, fewer deals, higher interest rates, little to no equity, etc.

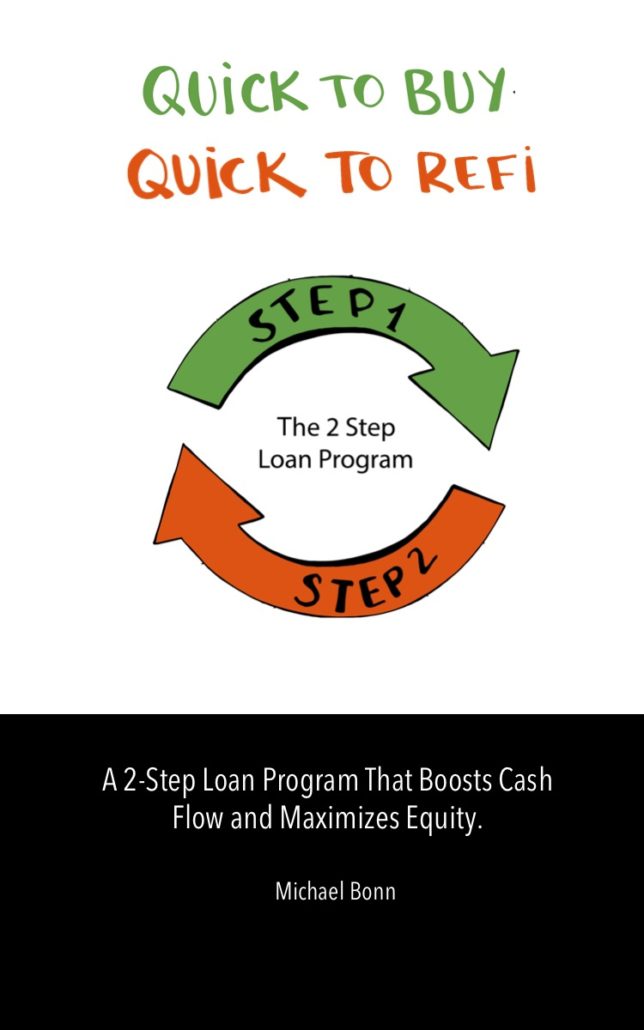

Why not kick your deals in the butt by pairing the BRRRR method with our Quick to Buy, Quick to Refi strategy? The 2-step loan program leads to more properties, increased cash flow, and bigger equity.

You know where these kinds of benefits lead to, right? Yep, you got it: living the life you want. No more waiting, no more saving up money, no more getting stuck in expensive short-term loans. It’s time to minimize the amount of cash you put into each deal and maximize your equity.

It’s time to take control of your future with the simple Quick to Buy, Quick to Refi strategy.

Let’s get going!

If you’re ready to take your real estate investments to the next level, then download our book for the 2-Step Program, Quick to Buy, Quick to Refi. It’ll show you how to multiply your free equity, boost your rental income, and start living the life you’ve always dreamed of!

Enter your name and email below to download Quick to Buy, Quick to Refi.

If you do not receive the download in your email inbox as well, check your spam and promo folders.

Disclaimer: Any and all data put into the spreadsheet originates from the investor, not The Cash Flow Mortgage Company. The Cash Flow Mortgage Company is not responsible for false or inaccurate calculations or investment decisions made by the investor.