How to Fund a Real Estate Deal: 5 Ways to Buy a Fix and Flip Property

Categories: Blog Posts

How to Fund a Real Estate Deal: 5 Ways to Buy a Fix and Flip Property

A lot of people interested in real estate investing don’t know where to start when it comes to purchasing a value-add property. They can find a perfect house to fix and flip or rent, but they don’t know how to actually BUY the house.

Most think, “Well, I’ll just get a loan.”

But many quickly realize they don’t truly know what “getting a loan” means or where to even begin.

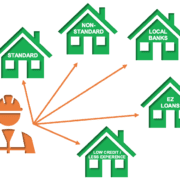

So, let’s take a quick look at the various types of real estate lenders you can rely on—and which ones you might have to rely on until you boost your credit score, build a real estate portfolio, or complete one of the other qualifications that some lenders require.

There are 5 different types of lenders, and each one has various pros and cons. Let’s start with the most simple and basic lenders.

Friend or Family Member

The upside to asking a friend or family member for a loan is, well, you’re asking a friend or family member for a loan. You know them, and you probably know them very well…well enough to ask them for money. The only qualification you really need is a decent relationship.

The downside is, well, you know them. They’re your friend, your dad, your sister, or someone else you have deep roots with. That makes the entire loan process way more personal, which means there’s a lot of potential for drama—both now and in the future.

Business Partner

Instead of going through a family member or friend, you can get a business partner. A business partner can lend you the money to buy a value-add property with very few if any qualifications. The big pro here is they take on most—if not all—of the financial risks. It’s their money, not yours.

On the flip side, it’s their money, not yours. That means some business partners get greedy. Rather than splitting profits fairly, they demand the lion’s share. To them, it might not matter if you were the one who did all the actual work. They took the risk, so they should get a bigger reward at the end of the day.

Hard Money

If you have some basic qualifications, you can skip the first two lenders we’ve talked about and get a loan through a hard money lender. Hard money loans (aka, Fix and Flip loans) are great when you need to close a real estate deal FAST. We’re talking days instead of weeks or months.

Unfortunately, hard money can be expensive. Rates tend to be higher than other lenders. But every hard money lender varies, so it’s absolutely worth shopping around. Plus, hard money loans aren’t intended to be long term, so the high cost can actually save you a lot of pain AND money in the long run.

What is hard money? Check out our myth busting series on YouTube!

Banks

Banks are the most traditional lender out there. In fact, most real estate investors look to this type of lender before they consider any other. And, why not? Banks usually have the lowest rates available.

Unfortunately, banks also have the strictest requirements, and if you don’t meet those requirements, you’ll get rejected. Worse, the application process is a lot more in-depth, which means closing can take A LOT longer. Which means that perfect investment property you wanted gets snatched up by someone using a faster lender.

OPM

Aka, “Other People’s Money.” This is exactly how it sounds. You use other people’s money to buy a property. This is different than asking a family member, friend, or business partner for financial help because there are more boundaries. With OPM, a lender charges interest. That’s it. There aren’t points or profits involved. It’s simple and easy.

The only downside of OPM is finding those who are willing to lend their money to you. But that’s where gaining experience and knowledge in real estate investing helps. The more you know, the more you can prove you’re worth the investment.

So, there you have it. Those are the 5 ways to buy a fix and flip property. Each one has its pros and cons, but each one is a viable option. It just depends on YOU and your financial situation.

Bad credit? No credit? You might have to start with a family member, friend, or business partner

Great credit? Solid income? Extensive real estate portfolio? You probably can jump straight to hard money or a bank loan. Or, better yet, OPM.

Each investor has a different path.

Ready to find out what your path is? Great! Our team is here to help. We’re excited to set you on a path that helps you make the kind of money you need…to live the life you want.

Happy investing!