How To Make More Money With More Lender Options

Let’s talk about how you can make more money with more lender options.

Because one of the biggest problems that impacts your cash flow is getting too comfortable with a single lender.

We’re talking about thousands-of-dollars-kind-of-impact.

Let’s face it. Sometimes it’s just easier to keep using the same lender for all your loans. But here’s the truth: Sticking with the same lender will suck money out of your pocket every month and make banks fatter.

Stop giving the banks your extra money every month!

That’s money you should be using to make your life easier and more enjoyable. If you want a leg up on most real estate investors, then spend an hour or so and shop around for lenders who can get you the best deal on each loan. Why? Because not all lenders are made the same or have the same products available. Or, worse, they think mainly of how much money they can make and not how much they can increase your monthly cash flow.

Let’s look at two examples that cost our clients thousands of dollars. All because they didn’t want to shop around or change their current lenders:

Example #1

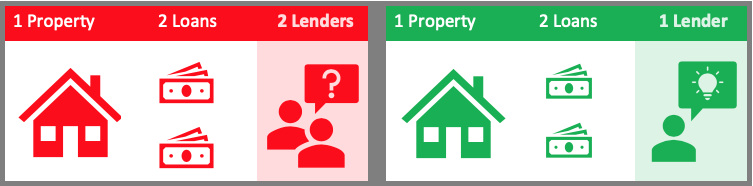

Our team recently spoke with two couples who purchased a fix and flip together and decided to keep it. Neither had tax returns that made the cut to qualify for a traditional loan. So, they needed to use a non-traditional loan that qualified them using bank statements for income.

An important side note: Once you venture into non-traditional loans, rates can vary greatly between lenders. There are fewer lenders who offer these products, which leads to them charging higher fees.

So, back to our example! Our two couples entered a loan for $575,000 that had a 5.8% interest rate. They stuck with this loan for two weeks until they called us to chat about other options.

Our team priced the same loan 1.5% lower. That cheaper rate saved them hundreds of dollars every month, which means they enjoyed a huge boost to their monthly cash flow.

Example #2

A real estate investor reached out to us to chat about a rental property he wanted to purchase.

His current hard money lender offered him a loan that wouldn’t require him to use his tax returns, because he writes everything off and doesn’t show taxable income.

He decided to call us to see if he had other options. Using just market rents and a good credit score for approval, we were able to quote him a rate 1.125% lower than the lender he was currently working with.

Again, this was a big cash boosting move on his part. All because he chose to shop around rather than stick with who and what he knew.

As the markets tighten, there ARE ways to increase your positive cash flow. And there ARE ways to get the best rates and loan products for your unique situation.

Often times, it pays to avoid hitting the easy button for your loans. We understand comfort zones are a big deal for a lot of real estate investors, especially when it comes to funding their value-add properties.

But if you don’t break out of your comfort zone, you and your cash flow won’t grow the way it could (or should). So do your due diligence and spend the time shopping around. Go ahead, and discover your lender options. If you do, we can guarantee you’ll see your cash flow soar.

Ready to chat? Great, our team is here to help. We’re excited to set you on a path the helps you make the kind of money you need to live the life you want.