Investor Mortgage Report 6.9.2020

Categories: Resources, Tips, Trends Tuesday

What We Know:

The markets are stabilizing, and underwriting term times are back in pre-Covid standards.

With rates for single-family investor properties on conforming loans hovering around the low 3’s, it might be time to look at locking in and increasing your cash flow.

What This Means for You:

As an investor, there is money in the money—Your money!

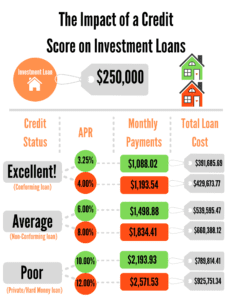

Your credit score is the key to keeping more of your money. No matter your income situation, the better your score, the cheaper the money. Cheaper money equals more cash in your pocket.

Last week, we showed you how much money can be saved with a good credit score. Now, it’s time to go over how to increase that score quickly.

How to raise your score and increase your cash and cash flow

Do you want to keep money in your life or keep supporting a banker’s life? We’re pretty sure we know the answer to that particular question.

They say that Vegas was not built on the gambler’s winnings. The same can be said about banks. Banks keep popping up everywhere, even when most banking has gone online.

Why is that? Because they know there’s money in your money.

So how can you better prepare your credit score for an investor loan?

- Plan before you apply by checking your score online.

- Stop applying for ANY credit at least 60 days before a loan application.

- Raise your score with one or two of these simple methods:

- Use private money when you can and keep it off your credit. If you can borrow from a private individual or entity that doesn’t report on credit to pay off/down your credit, do it BEFORE your next statement date.

- Don’t close paid off accounts.

- Pay down your credit cards before due dates. This will take extra cash now, but it will save you tens of millions in the future.

- Keep balances below 30% of outstanding balances on revolving accounts like credit cards.

- Dispute any item that should not be on your report.

This list does not include paying your accounts on time. That’s a no-brainer. You should always pay on time. There’s typically no quick fix for late payments.

Stay tuned, because next up, we’ll be covering how to check your credit on your own! In the meantime, if you have questions about your score, what it’s costing you, or what a better score could save you, reach out! We’re always happy to go over the numbers with you!

*All non-commercial and construction loans offered by TNS Loans NMLS #1719349