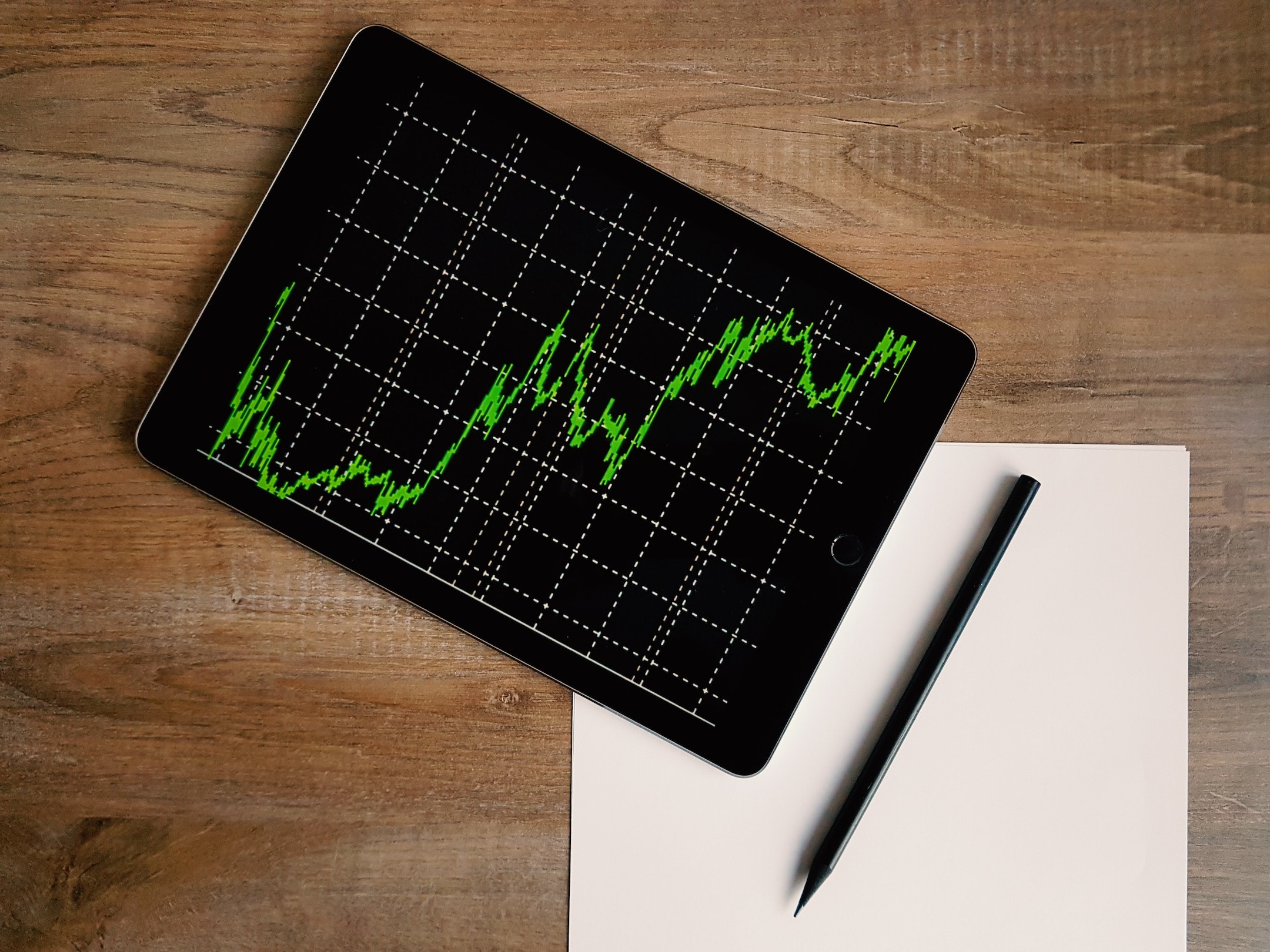

Investor Mortgage Report 4.21.2020

Categories: Blog Posts, Resources, Trends Tuesday, Wholesale Deal

The going is still tough out there for real estate investors looking for traditional financing.

What We Know:

This week doesn’t bring much (if any) relief to the mortgage markets. The Feds have slowed down buying mortgage back securities and closings are still tough.

We are seeing the majority of our payoffs being delayed 2-3 weeks as mortgage companies push loans through these uncertain times.

Unfortunately, this means–once again–the real estate investor doesn’t rank high on their list of loans to close (or close fast).

The good news? There are still lending options for Real Estate Investors. You just need to know where to find them.

Even though most traditional lending options are currently off the table, there is still one source that is interested in lending to real estate investors (at least in some markets):

Credit unions.

According to our market research, there are still a couple of credit unions maintaining business as usual. Better yet, they are still lending with good terms on rental properties.

Why do they seem less impacted than the rest of the lending world? The answer is heavily based on their loan mix. Unlike banks, credit unions do not have a heavy investment in all these small businesses that have closed down. (Remember, the closure of small businesses impacts banks via deposits and bad loans. Bad loans create a need for banks to slow down on all lending.) Secondly, a good deal of their mortgages are kept inside the credit union, and don’t rely on secondary markets to keep lending.

So, if they can make a good loan on a piece of real estate, they will.

What You Can Do:

Of course, not every credit union lends on rental properties. You will need to call around in your market to find out which ones offer this service.

Also consider that the ones who are doing these loans will be BUSY, and you’ll need to be patient. It took us 2 days just to get a call-back…that is just reality in the strange times we’re living in.

Want to stay on top of what’s happening in the market, as well as what you can do to help your investor business thrive in a post-pandemic lending world? Get signed up for our weekly webinar series and join our mailing list for info, insights, and action items geared toward helping you take the guesswork out of your funding.

Sign up here >>>>