How much money might a lackluster credit score be costing you over the life of your investment business?

You probably hear a lot of talk in the mortgage industry about your credit score and the effect it can have on your interest rates, but do you really have an idea of how much it’s affecting your bottom dollar?

Do you know how to determine your Return on Credit (ROC)?

Can you crunch the numbers to figure out how much your score is helping your cash-flow (or how much money it’s sucking out every month?)

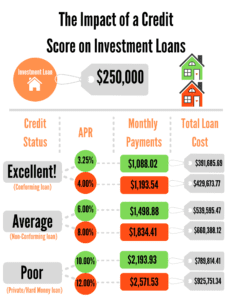

These calculations can get complicated, but the takeaway here is that a less-than-stellar score can really be costing your tens of thousands of dollars over the lifetime of your loan. And when your loan is on an investment property, (or several,) you may as well be lighting your profits on fire.

We want to help! Contact our team so we can help you see where you’re currently at, and where you could be going instead.

Let’s get you to your goals faster by trimming some of the fat from your financing!

Hard Money Mike is a lender based in Colorado offering services in several states. We lend money for all varieties of commercial-based properties. So whether you’re trying to finance a fix-and-flip, vacant land, whole-tailing, or looking for a builder bridge loan, we’ve got you covered.

Call Mike Bonn at: 303-539-3000 or email Mike@HardMoneyMike.com

*All non-commercial and construction loans offered by TNS Loans NMLS #1719349