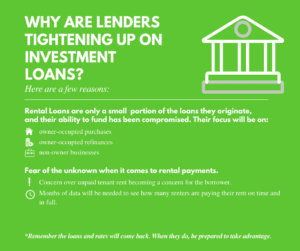

If you’ve been watching the mortgage industry reports over the past few weeks, it shouldn’t come as a shock to you that the banks are quickly closing their doors to investors. In fact, if you run an investment property business and have relied solely on traditional funding, it’s practically impossible to find money to close your deals the old-fashioned way.

But don’t give up hope just yet. We’d like the chance to introduce you to your new funding partner: Cash money.

If you need funds to close your deals, the quickest way to secure it in these unprecedented times to STOP relying on banks and traditional financing options. Believe it or not, there are tons of other sources of investment capital out there, and they just so happen to already be in your phone’s contact list.

When it comes time to fund your next deal, instead of turning to the bank and patiently waiting to be shot down, why not place a call to a potentially willing partner instead? Whether it be a grandparent, a fellow real estate investor, your golfing buddy, or your next-door neighbor, chances are you already know someone who might be looking to make their savings balance work a little harder for them (and therefore, you!)

Asking acquaintances or friends for funds can be a tricky subject, but with the right approach, it’s perfectly possible to do so while keeping it legal, safe, and honest – not to mention PROFITABLE – for all parties involved.

Don’t be beholden to banks. Money is king, so take back control of your financial future and put yourself where the money is.

We can help you start the conversation with our Guide to OPM Funding Webinar series! Get more info and signed up here >>>>